Family Fsa Contribution Limit 2024

Family Fsa Contribution Limit 2024. The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Individuals can contribute up to $4,150 to their hsa accounts for 2024, and families can contribute up to $8,300. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

The Irs Has Increased The Flexible Spending Account (Fsa) Contribution Limits For The Health Care Flexible Spending Account (Hcfsa) And The Limited Expense Health Care.

The irs confirmed that for plan years beginning on or after jan.

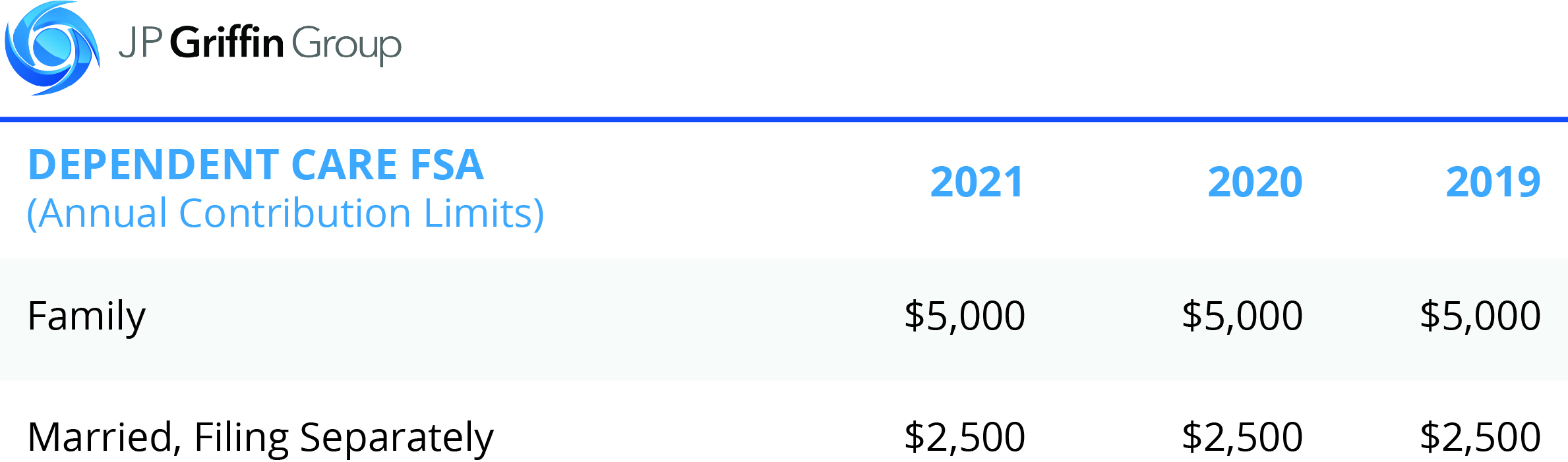

The 2024 Annual Limit For This Type Of Fsa Is $5,000 For A Married Couple Filing Jointly, Or $2,500 For Each Individual Fsa If You Each Have A Separate Account.

Unlike a healthcare fsa, dependent care accounts (dcas) offer a family contribution option, which means you only need one dca to cover your household.

Family Fsa Contribution Limit 2024 Images References :

Source: velmaqshelagh.pages.dev

Source: velmaqshelagh.pages.dev

Irs Fsa Max 2024 Joan Ronica, The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. Fsas only have one limit for individual and family health.

Fsa Contribution Limits 2024 Family Codi Marney, The fsa contribution limits increased from 2023 to 2024. Fsas only have one limit for individual and family health.

Source: stepheniewdionis.pages.dev

Source: stepheniewdionis.pages.dev

Hsa Limits 2024 And 2024 Rose Dorelle, The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). The internal revenue service (irs) increased fsa contribution limits and rollover amounts for 2024.

Source: philipawgerrie.pages.dev

Source: philipawgerrie.pages.dev

Fsa Limits 2024 Dependent Care Tera Abagail, The internal revenue service (irs) increased fsa contribution limits and rollover amounts for 2024. Fsas only have one limit for individual and family health.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2024 Health FSA Limit DSP, Download our bulletin to review the changes. The fsa contribution limits increased from 2023 to 2024.

Source: cammiqmaribeth.pages.dev

Source: cammiqmaribeth.pages.dev

Fsa Contribution Limits 2024 Irs Fallon Sharron, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year. For 2024, there is a $150 increase to the contribution limit for these accounts.

Source: www.cleveland.com

Source: www.cleveland.com

IRS increases FSA contribution limits in 2024; See how much, These amounts are approximately 7% higher than. Those 55 and older can.

Source: wilmettewsacha.pages.dev

Source: wilmettewsacha.pages.dev

Hsa Maximum 2024 Family Contribution Melly Leoline, The 2024 annual limit for this type of fsa is $5,000 for a married couple filing jointly, or $2,500 for each individual fsa if you each have a separate account. Dependent care fsa limits for 2024.

2024 Fsa Maximum Family Manon Christen, Dependent care fsa limits for 2024. Individuals can contribute up to $4,150 to their hsa accounts for 2024, and families can contribute up to $8,300.

.png) Source: shellywalexia.pages.dev

Source: shellywalexia.pages.dev

Has Irs Announced Fsa Limits For 2024 Jojo Roslyn, Our bulletin provides an overview of the health fsa contribution limit and the 2024 adjusted limits. Individuals can contribute up to $4,150 to their hsa accounts for 2024, and families can contribute up to $8,300.

This Is Unchanged From 2023.

The 2024 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023).

But If You Have An Fsa In 2024, Here Are The Maximum Amounts You Can Contribute For 2024 (Tax Returns Normally Filed In 2025).

Those 55 and older can.

Posted in 2024